Assembling an effective team

The individuals you name to assist with your estate plan should understand that they will be acting in a fiduciary capacity. Fiduciaries are guided by two key principles — loyalty and prudence — and are charged with always working in the beneficiaries’ best interests.

1. Trustee

A trustee is responsible for protecting and managing assets for the benefit of the beneficiaries. The duties of this complex role may change over time depending on the terms of the estate plan and the circumstances of the grantor and beneficiaries. Many trustees also serve in the role of executor. Due to the importance of a trustee role, many plans name contingent trustees to ensure a plan is executed even if there are unforeseen events that prevent the initial trustee from continuing to serve.

2. Executor

An executor is tasked with settling a probate estate within the guidelines of the decedent’s will and/or state law. For example, this may include selling property, paying bills, filing and paying taxes, and disbursing assets.

3. Agent

An agent works at the direction of an executor in settling an estate. It’s also common for a trustee to hire agents. An agent is frequently engaged due to the emotional and financial complexity of executing an estate plan. Agents can serve as a neutral party and help meet the fiduciary requirements of the plan.

Fiduciary duties over the life cycle of your estate plan

Event or situation:

If you are alive and well,

you or your agent advise and implement your estate plan. You build and monitor the plan, make sure you understand trust provisions, review asset ownership, and securely store key documents.

If you are temporarily or permanently incapacitated,

you or your agent pay bills, assess and coordinate care, manage assets, deal with family dynamics, and pay taxes. These can be ongoing duties that begin at the time of your death.

At the time of your death,

your executor or agent settles the estate and distributes assets, coordinates final tax filings, and may also mediate any disputes.

Your legacy continues

by your executor or agent managing assets, making decisions, administering trust provisions, and protecting assets. Trustees can play a role during all of these events and situations.

Selecting a trustee

Given the standard of care to which a trustee is held, and the sometimes-difficult decisions a trustee must make, choosing the right trustee is critical to your estate plan’s success.

One process you might follow to choose a trustee would be:

- Decide what kind of distribution provisions will be in the trust. Will they be fairly objective or more subjective, requiring greater discretion on the part of the trustee? For example, a trust might allow for a beneficiary’s “support.” Does this support encompass buying the beneficiary a house or merely paying the rent?

- Decide what kind of assets the trustee will be administering. Managing a controlling interest in a closely held business requires a very different skill set from managing a portfolio of marketable securities.

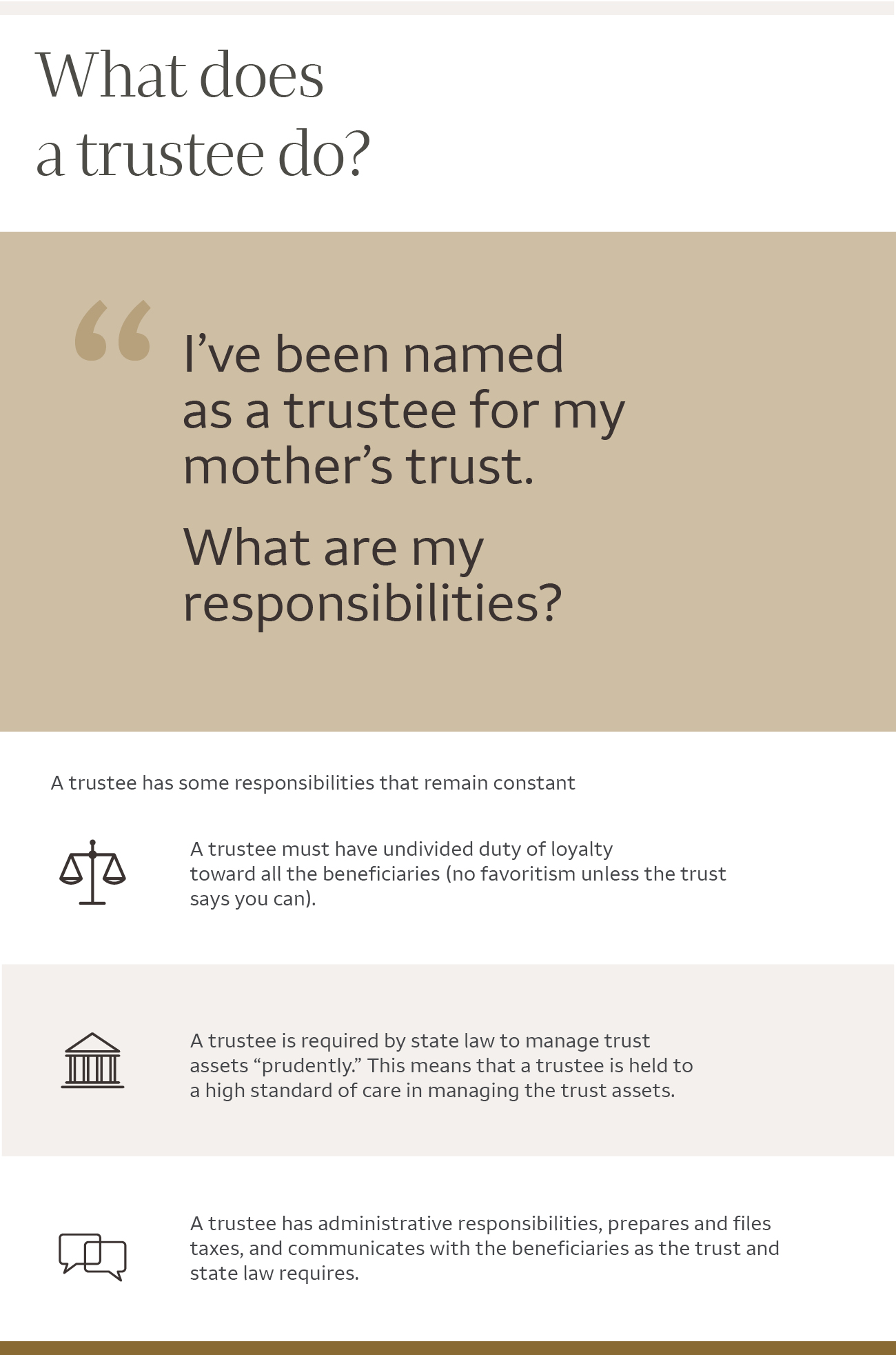

What does a trustee do?

I’ve been named as a trustee for my mother’s trust.

What are my responsibilities?

A trustee has some responsibilities that remain constant

- A trustee must have undivided duty of loyalty toward all the beneficiaries (no favoritism unless the trust says you can).

- A trustee is required by state law to manage trust assets “prudently.” This means that a trustee is held to a high standard of care in managing the trust assets.

- A trustee has administrative responsibilities, prepares and files taxes, and communicates with the beneficiaries as the trust and state law requires.

Professional trustees can serve the following functions to help descendants on their journey to financial well-being.

Some benefits of having a trustee

Coach for wealth transition

Teaching financial literacy early can help establish a foundation of knowledge the younger generation can build on as they gain awareness and understanding by sharing your view of wealth and the strategies you’ve adopted.

Trusts can be used as an educational tool to:

- Discuss distribution standards for health, education, maintenance, and support.

- Review alternative trust structures.

- Create incentive trusts.

Offer support and continuity

Trustees can support future wealth recipients by partnering with other financial professionals to continue the education and wealth transition process.

Execute your plan

Keeping well-informed about your estate plan at different life stages can be accomplished through the services of a corporate fiduciary. Key benefits include: regulation and oversight; availability of specialty services; objectivity; continuity across multiple generations; and asset management expertise.

Individual trustees vs. corporate trustees

The decision to appoint an individual or a corporate trustee and to choose the specific trustee requires thoughtful analysis. Individual trustees may be the better choice if a particularly close relationship with the beneficiary is needed or if the trust asset requires specialized knowledge. However, a trustee’s close relationship with a beneficiary can backfire: for example, it’s not always a good idea to name one sibling as the trustee for another sibling because emotional ties can get in the way of objective management decisions. Individuals also might be the better choice if the trusts are of smaller value or shorter duration.

Corporate trustees often are the better choice when:

- There isn’t a trusted individual who can both manage trust assets effectively and make the hard decisions about when (and when not) to make distributions.

- Individuals may be overwhelmed with trust administration and management of complex assets.

- Choosing an individual in certain circumstances would subject the trust to adverse income, gift, or estate tax.

You should consult with your estate planning attorney for assistance in selecting the appropriate trustee for your situation.

Who should be in charge of your estate?

It all depends on your assets. If they total less than $1 million, consider an individual trustee. However, if the trustee must have specialized asset management experience, consider a corporate trustee.

If your assets total more than $1 million, consider a corporate trustee. However, if the trustee must have a close relationship with the beneficiary, or specialized knowledge of something such as a family business, consider an individual trustee.

Regardless of the amount of your trust, if:

- There is no trusted individual

- The available individual would face adverse tax results

- The available individual would have conflicts of interest

- The trust is longer-term or multigenerational

- The trust is complex and requires additional oversight

Then consider a corporate trustee.

Consult with your estate planning attorney.

Benefits of naming a corporate trustee

1. Regulation and oversight

A corporate trustee’s actions are reviewed both internally by its own compliance group, and by state or federal regulators. Further, most courts hold corporate trustees to higher standards than individuals because they are considered professionals.

2. A broad array of services

A corporate trustee has fiduciary and investment specialists on staff as well as advisors that deal with nonfinancial assets. These professionals bring experience, which helps them identify opportunities to improve trust functions, like making certain tax elections.

3. Objectivity

Corporate trustees are often tasked to make unpopular decisions that individuals might have a harder time with, like telling a beneficiary “no” to a distribution request.

4. Continuity

Trusts are often long-term, multigenerational structures. A corporate trustee may provide continuity of trust administration, unaffected by incapacity or death.

5. Investment management expertise

Trustee investments are governed by state statute and almost always require a “modern portfolio theory” (or “total return”) approach. Corporate trustees rely on this approach in a disciplined manner.

Trustee selection is a critically important part of the estate planning process.

Are co-trustees a good idea?

A common question is whether a corporate trustee and an individual can serve together as co-trustees.

When it works well, this can be an excellent solution, combining the insight of a family member with the administrative experience and asset management expertise of a corporate trustee. To be effective, however, the co-trustee structure must be carefully considered and drafted. For instance, what happens if the co-trustees do not agree? Should there be two or three co-trustees? Should one trustee hold the deciding vote over distributions, investments, or sale of the family business? To help alleviate family discord, a corporate trustee could hold the deciding vote over distributions.

Still another possibility is to name a corporate trustee as successor, in the event that an individual trustee is unwilling or unable to serve.

The content is for educational and illustration purposes only; the outcome of any approach is based on individual facts and circumstances and legal and tax advisors should be consulted.

Wealth & Investment Management (WIM) offers financial products and services through bank and brokerage affiliates of Wells Fargo & Company.

Wells Fargo Trust is a part of WIM and offers services through Wells Fargo Bank, N.A. and Wells Fargo Delaware Trust Company, N.A. Any estate plan should be reviewed by an attorney who specializes in estate planning and is licensed to practice law in your state.

Insurance products are offered through nonbank insurance agency affiliates of Wells Fargo & Company and are underwritten by unaffiliated insurance companies.

Wells Fargo & Company and its affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.