One of the reasons the process can be daunting is that most people view estate planning in isolation, that is, they think of it as involving things that happen only after they’ve died. Viewed more comprehensively, estate planning is really just one component of a properly structured plan. Good planning goes beyond finances, cash flow, and investments, to provide for your family in the short-term and long-term.

Why have an estate plan? The reasons begin with providing for a spouse, partner, children, or others and aligning your wealth transfer with your charitable vision. But there are other things to consider, such as reducing the time and cost of estate settlement for your heirs and making sure that you are taken care of as you age.

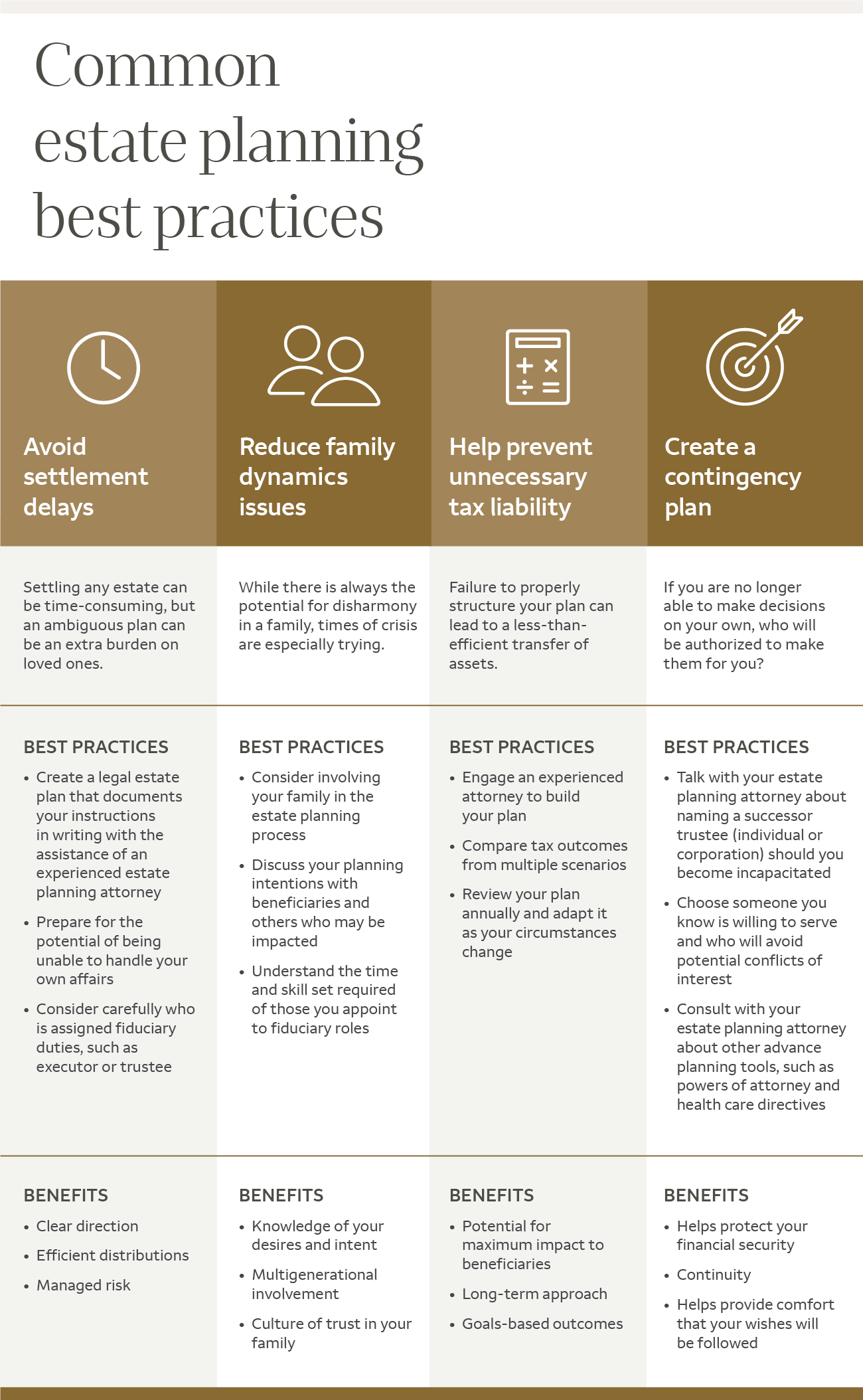

Refer to the chart below for estate planning best practices to consider.

Common estate planning best practices

Avoid settlement delays

Settling any estate can be time-consuming, but an ambiguous plan can be an extra burden on loved ones.

Best practices

- Create a legal estate plan that documents your instructions in writing with the assistance of an experienced estate planning attorney

- Prepare for the potential of being unable to handle your own affairs

- Consider carefully who is assigned fiduciary duties, such as executor or trustee

Benefits

- Clear direction

- Efficient distributions

- Managed risk

Reduce family dynamics issues

While there’s always the potential for disharmony in a family, times of crisis are especially trying.

Best practices

- Consider involving your family in the estate planning process

- Discuss your planning intentions with beneficiaries and others who may be impacted

- Understand the time and skill set required of those you appoint to fiduciary roles

Benefits

- Knowledge of your desires and intent

- Multigenerational involvement

- Culture of trust in your family

Help prevent unnecessary tax liability

Failure to properly structure your plan can lead to a less-than-efficient transfer of assets.

Best practices

- Engage an experienced attorney to build your plan

- Compare tax outcomes from multiple scenarios

- Review your plan annually and adapt it as your circumstances change

Benefits

- Potential for maximum impact to beneficiaries

- Long-term approach

- Goals-based outcomes

Create a contingency plan

If you are no longer able to make decisions on your own, who will be authorized to make them for you?

Best practices

- Talk with your estate planning attorney about naming a successor trustee (individual or corporation) if you are incapacitated

- Choose someone you know is willing to serve and who will avoid potential conflicts of interest

- Also talk with your estate planning attorney about other advance planning tools, such as powers of attorney and health care directives

Benefits

- Helps protect your financial security

- Continuity

- Helps provide comfort that your wishes will be followed

Trust services are available through Wells Fargo Bank, N.A. Member FDIC and Wells Fargo Delaware Trust Company, N.A. Any estate plan should be reviewed by an attorney who specializes in estate planning and is licensed to practice law in your state.