Understanding probate, wills, and trusts

When people think of what happens to their property at death, they usually think of wills and probate. However, with more people using vehicles that aren’t subject to probate, such as revocable living trusts, going through the probate process can be optional.

Probate basics:

- If a will is the primary tool being used to transfer assets at death, it often needs to be “probated.” Probate is a legal process to establish the validity of a will and formally appoint a Personal Representative. Historically, the probate process was expensive and drawn out. While this perception continues, many states now have a much more streamlined probate process.

- If a person dies without a will, any property subject to probate will pass to the decedent’s heirs as determined by the court. The court uses state “intestacy” laws to determine heirs. If a decedent died with debts, probate has a defined process to settle creditor’s claims.

Understanding probate, wills, and trusts

What is probate?

Probate is a court-supervised process that:

- Verifies the will’s authenticity

- Oversees the Personal Representative’s payment on any outstanding bills

- Oversees the Personal Representative’s distribution of the estate’s assets

What are the drawbacks?

- Probate process can be long and expensive

- Probate proceedings are a matter of public record

- Property in different states often requires a probate filing in each state

What is a will?

- A legal document where you can nominate a Personal Representative and state how you want your probate assets to be distributed

- A document most often used to nominate guardians for minor children

- Typically, less expensive than a trust to establish

What is a trust?

A legal arrangement that involves three parties and typically allows the grantor to direct how they would like their assets handled in the event of their incapacity or death:

- The grantor of the trust

- The trustee

- The beneficiaries

Trust basics:

- Assets are owned by the trust, not your estate

- If you should become unable to handle your affairs, a co- or successor trustee can take control

- At your death, the property funded to the trust passes according to the trust terms, without going through probate

- Unlike probate, the terms of a trust are private and not part of the public record

Revocable living trusts basics

A trust is a legal arrangement involving three parties. The grantor places assets in a trust, which is administered by a trustee for the benefit of the beneficiary. A revocable living trust, created during the grantor’s lifetime, can be revoked, meaning the grantor still has control over the assets.

In the case of revocable living trusts, the grantor is often the trustee and the beneficiary. The grantor may also name beneficiaries to receive the assets after their passing.

A trust allows for a successor trustee to manage assets upon incapacity of the grantor, and for simplification and privacy in administration after death.

Please be aware:

1. A trustee only has authority over assets owned by the trust.

2. Qualified retirement accounts are tax sensitive assets. Confer with your accountant or attorney before funding these assets to a trust.

3. Assets not transferred to a revocable trust may be subject to probate upon the owner’s death.

Trusts for the benefit of others may help protect beneficiaries from:

Self

Protection against lack of financial experience; or for a disabled beneficiary.

Common trust provisions

- A trust may terminate at predetermined ages or last for a lifetime as is more common for disabled beneficiaries

- May influence beneficiary behavior toward personal growth and financial development

Beneficiary considerations

- Assess distributions beyond age attainment and in terms of inflation-adjusted dollar amounts or other applicable economic benchmark

- Educate beneficiaries about financial markets and other factors affecting their beneficial interest

- Prepare beneficiaries for wealth transition by introducing them to financial advisors

Others

Protection from others, such as creditors or a spouse in a divorce settlement.

Common trust provisions

- Address potential undue influence

Beneficiary considerations

- Grant control, as appropriate, to remove and replace trustees, and serve as trustee along with professional trustee.

Some assets are not easily divided among multiple beneficiaries, like a family cabin. If joint ownership of an asset is anticipated, keeping the asset in trust instead can provide a structure for good governance in the future. Having a structure for ownership of the asset can help protect the asset from a breakdown in relationships between beneficiaries or creditors of any single beneficiary.

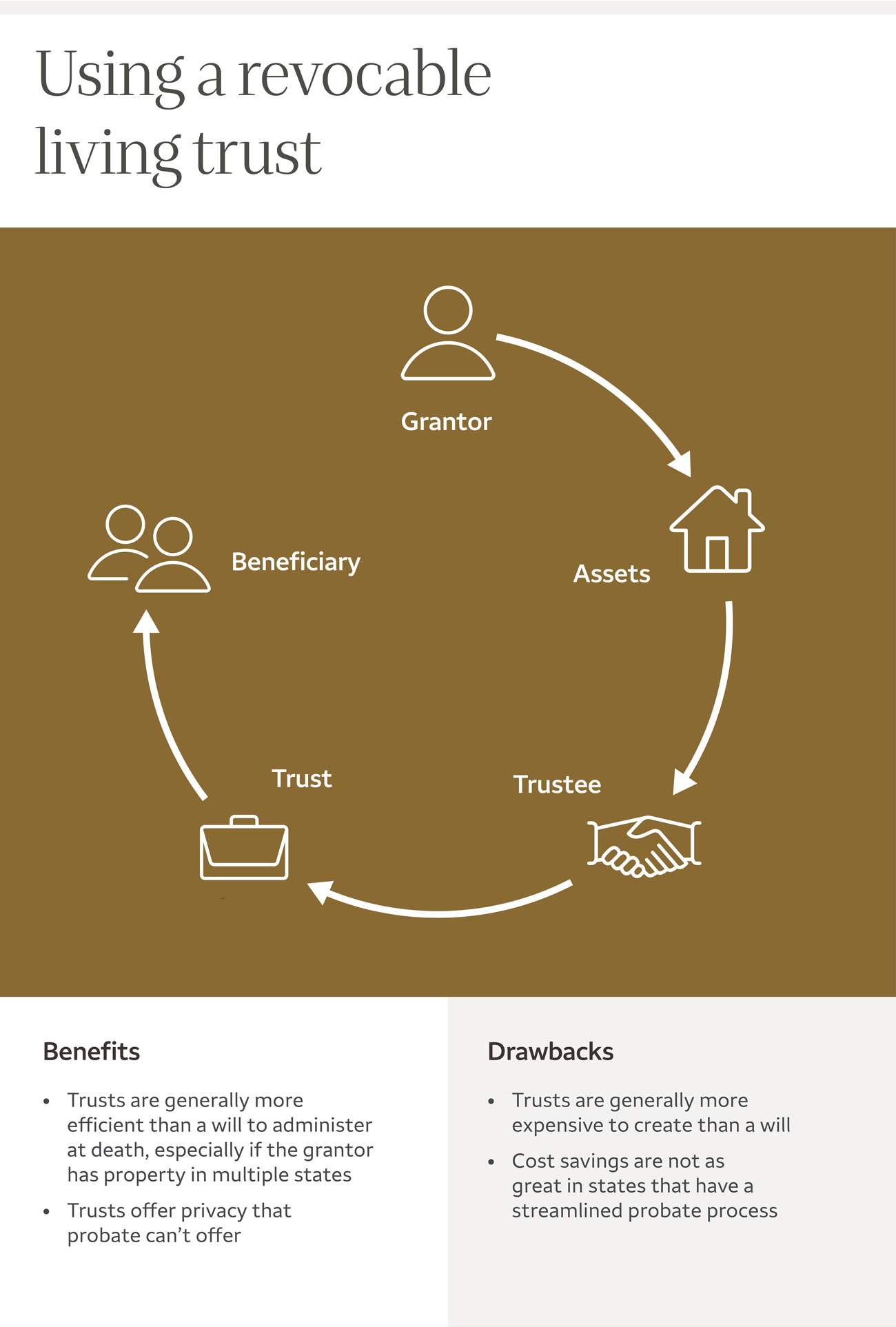

Using a revocable living trust

Top of graphic shows the “life cycle” of a living trust: A grantor transfers assets to the trust; a trustee oversees the trust; upon grantor’s death, trustee makes distributions to beneficiary or beneficiaries.

Benefits

- Trusts are generally more efficient than a will to administer at death, especially if the grantor has property in multiple states.

- Trusts may offer privacy that probate can’t offer.

Drawbacks

- Trusts are generally more expensive to establish than a will.

- Cost savings are not as great in states that have a streamlined probate process.

The importance of funding trusts

Drawing up trust provisions to provide for heirs is just the first step. Where people may fall short is in actually funding the trust by transferring assets to the trust.

Trusts can hold most asset types — from liquid assets such as deposit accounts to more variable assets such as investments, real estate, and business holdings.

Titling assets

Assets are typically funded to a trust by either changing ownership to the trust during your lifetime or being left to the trust after your death with a beneficiary designation. Your trustee can only control the assets owned by the trust at any given time.

It is important to work with your estate attorney and other advisors to decide what assets you will transfer to your trust and whether transfer of ownership should happen during your lifetime or after death.

Other trust considerations

There are many benefits to using a trust to hold assets, including privacy, tax efficiency, and protection for both your assets and beneficiaries. Choosing the right wealth transfer strategy for your needs can be complicated, so be sure to consult with an estate planning attorney who can help you evaluate options.

Here are some examples of how estate planning can help you achieve your goals:

- If you want to provide for your grandchildren, you may want to consider whether a family pot trust makes more sense than individual trusts. With a pot trust, you set up a single trust, and your trustee can decide when and how much money to distribute to each of your grandchildren or other descendants for their specific, ongoing needs.

- If you have a child or a dependent adult who is living with a disability, your long-term plan may involve creating a special needs trust to help manage the funds you are leaving for your dependent’s care. Your dependent will continue to need a variety of services and support, such as caregiving and recreational opportunities. Work with your advisor to find a special needs trust attorney who can help you determine whether such a trust is advisable to preserve eligibility for current or future public benefits.

Trust services available through banking and trust affiliates in addition to non-affiliated companies of Wells Fargo Advisors. Any estate plan should be reviewed by an attorney who specializes in estate planning and is licensed to practice law in your state.